Higher Education Notes and Trends for the Week of July 25, 2016

Last week in higher education was all about technology impacting student outcomes and teaching methodology. This week, the buzz is around the almighty dollar. We’re seeing higher education become one of the focal points of the Democratic party’s 2016 U.S. Presidential election platform. We also found an interesting study that highlighted the usage of “open” textbooks and the impact they can have on student costs. Did we mention higher education pays? Read on to learn more.

Open Textbooks Gaining Momentum, but Still Need Broader Adoption Strategy

As someone who can still remember the sting of purchasing textbooks every semester, the thought of open textbooks gets me excited. Semester after semester I would scour eBay, hunt classmates on Facebook who had taken the courses I had registered for the previous semester and grudgingly make my way to the bookstore to pay for the books I couldn’t find used.

It was an incredibly painful experience, as even the used books were $75+. And the most frustrating part? It seemed as if every other semester the version of the textbooks would be updated, meaning all of the used books available prior to that were useless, putting high upward pressure on the prices of used books that were in short supply. I often thought, “There has to be a better way than this.”

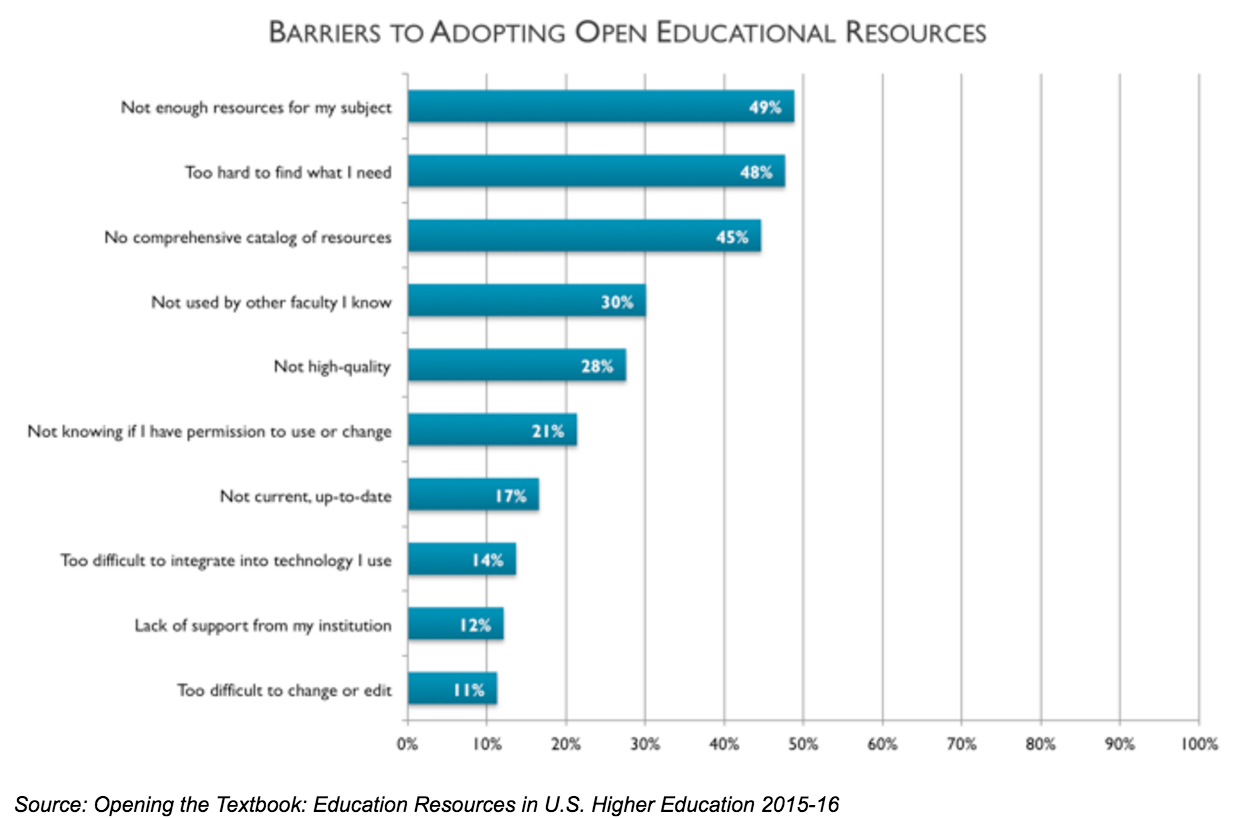

In a time when tuition prices and student debt levels are getting near-constant attention in the media spotlight (more on that below), textbooks are the forgotten cost of doing business for students. It wasn’t uncommon for my books to cost $500 per semester, which was roughly 18% of my tuition. A new report, “Opening the Textbook: Education Resources in U.S. Higher Education 2015-16”, shed some light on the usage of free or inexpensive “open education resources” (OER).

The study found that 58.1% of faculty members surveyed were not aware of the concept, or where to find alternatives to traditional textbooks. As one might expect, introductory courses offered the highest adoption rate of OER with rates dropping as the courses become increasingly specialized. Although a broader adoption strategy is still required to significantly increase usage rates, it’s exciting to see a more student-focused solution being discussed.

Student Debt: a Hot Topic at the Democratic National Convention

It was hard to miss the prevalence of higher education topics at the DNC this week. The stark contrast between the Democratic party’s view on student debt vs. Donald Trump’s failed “Trump University” initiative was highlighted early and often throughout this week. We analyzed Hillary Clinton’s “Technology & Innovation Agenda” a few weeks ago, where she promised to lobby for free tuition for kids who come from household incomes below the $125,000 annual threshold.

At the time, I openly questioned if the proposal was in direct response to the fierce socialist values that Bernie Sanders supporters were so vocal about, and pending the formal announcement of her nomination as the Democratic party leader, was perhaps Clinton’s way of bridging the gap with Sanders’ supporters and ensuring their votes come November.

It would appear I was thinking small with this hypothesis; it was apparent from watching the DNC that the Democrats are going to use higher education, both past experience of the candidates and proposed policy, as a way of showcasing their value alignment with the middle class. Trump, on the other hand, is using fear to connect with America’s middle class, capitalizing on the civil unrest and international incidents that have occurred of late. Looking at his website, no mention of higher education appears on his positions page. Could higher education be a lynchpin of this election? We’ll soon find out.

Research Shows Higher Education Still Worth the Investment

The University of Ottawa published a study that reviewed income data for 620,000 graduates from 14 Canadian universities and colleges between 2005 and 2013. The results are what you would expect -- a strong correlation between higher education and both starting income of graduates and earning potential over time. The study found the average university graduates from 2005 made $45,200 in inflation-adjusted income their first year out of school, with college graduates earning $33,900.

By 2013 those salaries had increased to $74,900 and $54,000, respectively. The study shows that attending any form of higher education makes a positive impact on the income of Canadians. The study did, however, highlight the ongoing wage gap between men and women. With starting wages in 2005 averaging $46,800 and $44,000 for men and women respectively, by 2013 men were earning $89,800 while women only $62,500. The study only reports the wage discrepancy and does not attempt to understand its causation.

Tuition Discounts: It’s on the Rise

U.S. News posted a very interesting read that aggregated several studies on the topic of tuition discounts throughout both private and non-private institutions. 48.6% is the average discount on tuition for first-time, full-time students at private, nonprofit colleges. That means that $0.48 of every $1.00 spent on tuition is returned to the student in the form of a discount, scholarship, or grant.

The article does a great job showcasing the impact of free-market concepts like supply and demand on higher education institutions, noting that the prevalence of discounts is becoming a self-fulfilling prophecy with traditional full tuition-paying students “rebelling” against paying the sticker price of tuition. Definitely worth the read.